The Power of Compound Interest – A Simple Way To Get Rich

What is the one thing all successful investors have in common?

What is the one thing all successful investors have in common?

They understand the power of compound interest and they invest for the long-term to take full advantage of this ‘eighth wonder of the world’ as Albert Einstein referred to it.

One of the reasons people find it so hard to get out of debt is because the power of compound interest is working against them.

The lender is using this simple way to get rich at the expense of the borrower.

What is this power of compounding?

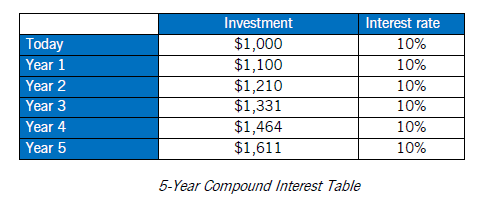

In a nutshell, compounding is interest on interest. Let’s say you invest $1,000 at 10% per year. At the end of the year, you will have $1,100 (10% x 1,000).

Now let’s assume that instead of liquidating your investment, you roll it over for another year at the same interest rate (10%). At the end of year two, your investment will have grown to $1,210 ($1,100 x 10%) as you can see from the table below:

This can be worked out by using a simple spreadsheet.

This can be worked out by using a simple spreadsheet.

Assuming that you keep reinvesting your money at the same interest rate, by year five your investment will have grown to $1,611, an increase of 61% from your original outlay of $1,000.

It is important to note that you did not have to do any extra work to earn that interest income of $611.

How can you use this in the real world?

So how can you apply this to the real world? How about your children’s education fund? The best time to start investing for your children’s education is before they are born.

This is because you have a lead time of at least three to five years from when they are born to start spending money on their education.

To make this work, you have to look for investments that do not present any downside risk. That is the potential that your investment can be eroded to below your initial $1,000.

Such investments can include fixed deposits and stock options. The number one basic rule of investing applies here as well – only invest in what you understand.

Another practical application of this principle is in business. If you want to grow your business quickly, you can reinvest your earnings or profit five to seven times before you spend any of it on non-business related projects.

A big mistake that kills many businesses is using all the profit to take care of needs and wants outside the business instead of retaining it to fund growth opportunities.

If it is so simple, where is the catch?

Using the power of compound interest is a simple way to get rich, although you should not confuse simple with easy.

For starters, putting aside money and watching it grow while resisting the temptation to spend it requires a very high level of financial discipline which many people lack for various reasons.

Secondly, finding reliable investment vehicles which will give you a consistent return on a regular basis with no downside risk is not exactly a walk in the park. However with the right knowledge and information, this should not be much of a hurdle.

Regardless of how much money you earn, you need to start investing to take advantage of the power of compound interest as opposed to letting it work against you.

Leave a Reply