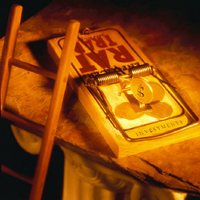

4 Investment Mistakes You Want To Avoid

When it comes to investing, it is natural to think about the stock market and how much money you or someone you know may have lost in an attempt to trade in stocks.

When it comes to investing, it is natural to think about the stock market and how much money you or someone you know may have lost in an attempt to trade in stocks.

There is more to investing than trying your ‘luck’ in the stock market, especially when you are buying shares in companies you know very little about.

Investing money on impulse is one of the biggest causes of financial loss to the aspiring investor.

To create wealth, you need to have a good understanding of what investing is all about. In this article, we will cover 4 investment mistakes that you may be making without your knowledge.

1. Failing to invest

The first investment mistake is a failure to invest at all. This is usually as a result of either a lack of information about how to grow your money, or a series of excuses as to why investing is not for you.

One of the fastest ways to grow your money is to invest it to take advantage of the power of compound interest.

There is no single investment out there that is right for everybody.

The right investment for you will depend on how much money you have for investment purposes, how soon you want to earn from your investment, and your risk appetite, among other things.

You therefore need to take the time to think about your investment objectives.

2. Being unclear about the return on your investment

The main reason behind investing is to get the best return on your money. Different investment vehicles like real estate or stocks and bonds will have various returns, even within the same economy.

You therefore have to choose the best alternative based on your financial goals. This requires a good understanding of the effects of inflation, taxes, and time on the value of your money.

Ideally, you should aim for a return that still makes the investment profitable after these effects have been taken into account.

3. Failing to distinguish between cash flow and capital gains

Understanding the difference between cash flow and capital gains can enable you to decide on the right investment for your purpose.

When you invest for cash flow, you are expecting to receive money from your investment at regular periods of time.

On the other hand, investing for capital gains means you are buying low, expecting to sell high at a future time usually without attaching much importance to whether you receive any money in the interim.

The best investments usually offer both cash flow and capital gains. Make sure you keep your goals in mind when making the decision to invest.

4. Not knowing when to cut your losses

If you have invested money before, you have probably lost money in the process. There is nothing wrong with making mistakes for as long as you learn from them.

What distinguishes the shrewd investors from the rest is that they have established a loss threshold beyond which they will count their losses and walk away with whatever is left of their money.

This is because they have mastered the art of focusing on the numbers as opposed to falling in love with an investment idea.

Knowing when to cut your losses can sometimes save you from losing all your money.

Investing like anything else in life requires a structured approach, and starts with educating yourself about the various options available to you on how to multiply your money.

Leave a Reply